Corporate and governmental interest in ESG (Environmental, Social, and Governance) has continued to gain steam. “Last year, the SEC began working on its new measure that would require U.S.-listed companies to provide investors with detailed disclosures on how climate change could affect their business” (Reuters). With a proposal reported to come in the next week, this is one way the SEC is cracking down on ESG-related measures in 2022.

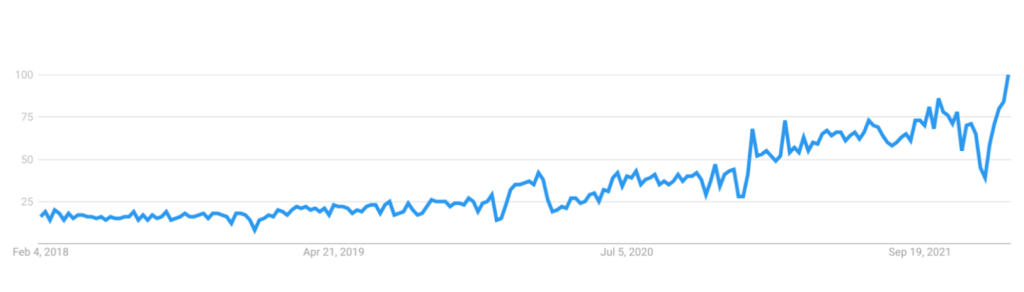

Google Search Frequency for the term “ESG”, February 2018 – February 2022

ESG is a broad-reaching topic, encompassing the following:

“(a) environmental, e.g., greenhouse gas emissions and emissions of other air and water pollutants, waste management; (b) social, e.g., human rights, labor rights, working conditions, health and safety, employee relations, employment equity, gender diversity and pay gaps, anti-corruption, and impact on local communities; and (c) governance, e.g., ownership and structural transparency, shareholder rights, board of directors’ independence and oversight, diversity, data transparency, business ethics, and executive compensation fairness.”

Arnold & Porter

This would differ from the SEC’s 2010 environmental rule which “did not…create specific reporting requirements related to climate change or other ESG-related matters” (Arnold & Porter). While corporate groups are continuing to push for a “narrower final rule that will make it easier and less expensive to gather and report emissions data, and which will protect them from being sued over potential mistakes”, the importance of having specific data requirements from an environmental perspective, cannot be understated (Reuters). Doing so, however, would require businesses to have access to sustainability data across their supply chain.

According to Wall Street Journal, “[t]he climate-change rules are among the most ambitious and closely watched items on SEC Chairman Gary Gensler’s agenda. They are likely to require companies to report more standardized information about their greenhouse-gas emissions as well as climate-related risks they face now and in the future, Mr. Gensler has said.” This last piece—being able to identify climate-related risks that could impact the business, and therefore, investors—requires companies to invest in technology and reporting that will provide accurate data across supply chains, so that they can better anticipate future risk.

Having more insight into your supply chain is never a bad idea. Gaining clearer visibility into the daily operations of your suppliers and manufacturers, especially if they’re located overseas, allows you further transparency with consumers and governmental agencies. Furthermore, “ESG-related disclosures should have the same factual support as would be expected of all other public company disclosures, so the board of directors and management should identify the appropriate sources of information” (Arnold & Porter).

Investing in a supply chain serialization and data gathering system like Vi3’s will provide you a reliable source for the information you need. With live-time reporting and tracking against globally-recognized sustainability certifications, you can take an important step towards your own sustainability goals, and ensure you’re better prepared for any legislation to come.

Curious about other sustainability laws that could impact your business? Read more about the German Supply Chain Law and the EU’s Circular Economy Action Plan here.